Recent development at CrunchBase

Launched in 2007, CrunchBase has quickly become a fantastic resource for the startup community. Even though the database has always been accessible through the CrunchBase API, CrunchBase released in April 2013 an Excel spreadsheet containing a significant portion of the dataset, so that more people would be able to help improve the accuracy of the data.

The CrunchBase team has also launched in May the CrunchBase Venture Programme to gain support from US VC investors in building out a more open, timely, and accurate dataset.

Sadly, the focus of these initiatives has only been in the US so far (the downloadable Excel spreadsheet, for instance, does not include data from European countries), and yet CrunchBase’ European data would really benefit from the initiative: I estimate that the dataset is less than 15% accurate in Europe versus c.80% in the US.

Estimating the accuracy of the CrunchBase dataset in the US vs. Europe

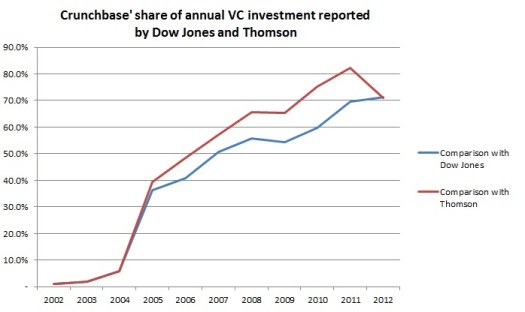

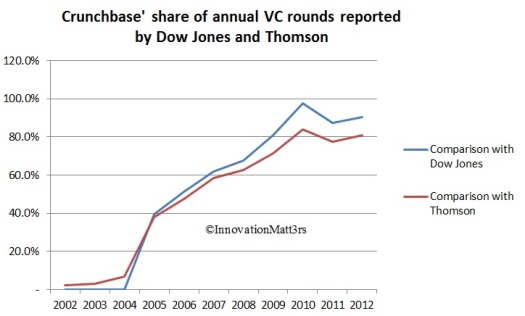

My estimates are based on a comparison of the yearly total VC investment in start-ups and the yearly number of rounds reported in Crunchbase versus ‘more reliable’ sources (Thomson and Dow Jones VentureSource). Here is a chart showing the CrunchBase accuracy rate in the US for different calendar years:

These charts show a clear improvement of the CrunchBase’ US dataset over time, from below 10% accuracy prior to 2004 to above 70% after 2011.

I repeated the same analysis for CrunchBase’ French VC deals/start-ups and found that the accuracy was below 50% for 2002-2009 data (based on an extraction of the Crunchbase dataset in July 2010). I have only repeated the analysis for France (I could not easily find historical investment data for other European countries) but I suspect that the CrunchBase dataset is weak in many European countries. This would not be surprising: webstatdomain.net shows that Techcrunch.com only gets limited traffic from European countries: the UK (3.7%) and the Netherlands (1.4%) are the only two countries appearing in the Top 10 by share of visitors.

Improving the CrunchBase dataset would greatly benefit Europe’s start-up community: a public, free and comprehensive directory of investors, start-ups and key employees is the first step towards enhanced transfers of skills, experience and investment across European countries.

Therefore, dear Techcrunch, could you please expand the CrunchBase Venture Programme to Europe? Here is a good place to start in the UK and in France:

List of major VC funds in the UK not yet members of the Programme (source: Inn0vationMatt3rs):

| Index Ventures |

| Accel Partners |

| Bessemer Venture Partners |

| Wellington Partners |

| Kleiner Perkins Caufield & Byers |

| Benchmark Capital |

| Atlas Venture |

| North Bridge Venture Partners |

| Meritech Capital |

| Institutional Venture Partners |

| Polaris Venture Partners |

| Summit Partners |

| First Round Capital |

| Greycroft Partners |

| Battery Ventures |

| Sigma West |

List of major VC funds in France not yet members of the Programme (source: Chausson Finance):

| Idinvest Partners |

| Truffle Capital |

| A Plus Finance |

| Iris Capital |

| OTC Asset Management |

| Omnes Capital |

| Innovacom |

| AXA Private Equity |

| Time Equity Partners |

| XAnge Private Equity |

| Midi Capital |

| Cm-Cic Capital Prive |

| Ace Management |

| Alven Capital |

| Turenne Capital |

| Seventure Partners |

| Sofinnova |

How accurate is CrunchBase? – Part 2 – Inn0vation Matt3rs

CrunchBase Goes Pound for Pound With VentureSource – Insights From Guillaume Goujon | Info @ CrunchBase