I’ve just found out about Ventureloop.com. This website provides what looks like a pretty comprehensive listing of available job positions in VC-backed companies throughout the world.

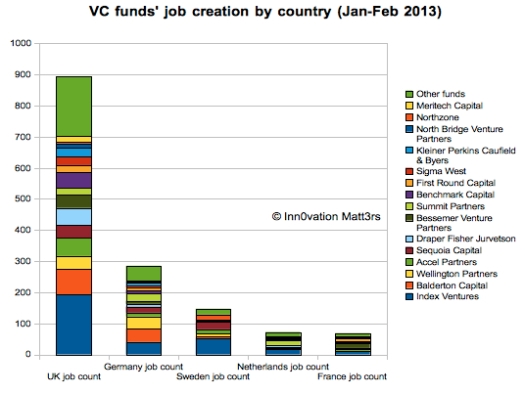

I thought it would be interesting to crunch that data to see what insights it can provide. Having a vested interested in the EU innovation eco-system I focused my analysis on the top 5 EU countries by number of jobs listed in the Ventureloop database for the period 15 of January to 28 of February 2013 (i.e. 7 weeks), which were as follows:

- the UK with c.900 jobs (49% were in the Greater London area)

- Germany with c.290 jobs

- Sweden with c.150 jobs

- the Netherlands with c.70 jobs

- France with c.70 jobs

In total 1,465 jobs were listed on the Ventureloop website over the last 7 weeks. If job creation is equally distributed over time and assuming the Ventureloop database is exhaustive this would amount to a total of c.11,000 jobs created by VC-backed start-ups in Europe in 2013… not bad!!

I tried accessing older job listings from the Ventureloop database, via the Wayback Machine (web.archive.org) but they were not available. I may carry out this analysis again in 3 months to see how the results presented below evolve over time.

With no further ado, here goes the output of my data crunching (click on the pictures to enlarge):

Based on this analysis, the Top 15 of VC funds based on job creation* in Europe was as follows in descending order:

| Rank | VC fund name | Total jobs created |

| 1 | Index Ventures | 312 |

| 2 | Balderton Capital | 130 |

| 3 | Wellington Partners | 92 |

| 4 | Accel Partners | 92 |

| 5 | Sequoia Capital | 90 |

| 6 | Draper Fisher Jurvetson | 72 |

| 7 | Bessemer Venture Partners | 71 |

| 8 | Summit Partners | 65 |

| 9 | Benchmark Capital | 63 |

| 10 | First Round Capital | 46 |

| 11 | Sigma West | 41 |

| 12 | Kleiner Perkins Caufield & Byers | 38 |

| 13 | North Bridge Venture Partners | 26 |

| 14 | Northzone | 25 |

| 15 | Meritech Capital | 21 |

I will shortly publish another post, showing how this job creation was split by start-up and by industry segment – watch this space 😉

Note:

*In cases where a start-up was backed by several VC funds I assumed an equal share of capital investment from VC backers and distributed to each VC fund an equal contribution of job creation. For instance a start-up with 3 backers with 5 jobs offering would result in a job creation of 5/3=1.66 attributed to each of the 3 VC funds